Update January 15, 2014, The final chapter: Citi called today and the best explanation I could get was, “We had an identity theft concern.” They didn’t exactly apologize — but they did offer that someone didn’t follow their internal procedures. But they did reinstate the account — meaning I can top up my purchases to get the original mileage offer. It’s a good, if not entirely satisfying outcome.

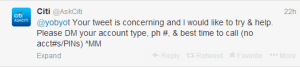

Update January 14, 2014: Citi was all apologies, concerned and “wanting to make it right” yesterday after I posed this blog entry. Here’s their reply on Twitter:

Well, I DM’ed them as requested…and whadda think? That they called? Dream on.

Original post, January 13, 2014: I’ve known for a long time that Citicorp isn’t among the most consumer-friendly companies in the country. (Nearly five years ago, in one of the better epithets I’ve coined on this blog, I called it the “Bank of Kafka.”)

The bank was too big to fail during the Great Recession, receiving $476.2 billion — with a “B” — from TARP. Now, they’ve paid it all back, are healthy and can get right back to treating customers like dirt.

I have recently been reminded of how good they are at throwing sand in customers’ faces. Here’s my New Year’s Eve encounter with Citi.

We have a tradition: Chinese food while we watch the ball drop. There’s something about juxtaposing the stupidity of the ball drop with overly-salty, fatty Chinese food that always makes for a good time. (Interesting fact: Tricia and I have been in Times Sq. twice for the ball drop. And not in the post-“Friends” Disneyland version of NYC you see today. We were there in early 1980s, when NYC was more filthy, more dangerous and much more real. And oh so much more fun!)

We called in our order as usual and when we went to pick it up, my Citi AAdvantage MasterCard was declined. No problem. I just paid with another card.

On the way home, I called to find out why it was declined. I was told it wasn’t just declined — it had been cancelled at the bank’s discretion. I was told an explanation would be forthcoming. It’s now almost two weeks later and, surprise!, not a word from Citi.

Well, I have an explanation. See, we’re good credit risks. We pay on time — and in full. A couple of months ago, Citi mailed me a come-on for an AAdvantage MasterCard: spend a certain amount in 90 days and get a boatload of miles. And the first year of the card is free. Well, they must have known my plan: spend the amount needed, get the miles and then cancel the card before the renewal.

IOW, they knew they wouldn’t make any money from me. I don’t pay usurious credit card rates. (Citi’s are among the highest and their method of computing interest is the most expensive the law allows.) And they probably could predict that we wouldn’t renew a credit card that costs, I think, $95/year when so many other cards are free. In short, they didn’t want to make good on their offer — and, no, no, no!, they’ll never admit that. But if the shoe was on the other foot, would Citi let me let me walk away from a commitment without an explanation? I don’t think so. In fact, even with an explanation they’d sue my toochis off.

How far away were were from cashing in on the offer? About $57. It’s just too coincidental to be an accident.

You’d have a hard time convincing me that their offer was anything other than a come-on from the beginning– the kind of come-on you get from robo-callers offering to reduce your credit card rates. The difference is, Citi gets to do it with taxpayer money (Yes, yes, they paid it all back. But would they even be here if they hadn’t been rescued?)

I wonder if American Airlines, whose brand is damaged by Citi’s actions, is wise to the trick. AA gets paid by Citi for those miles — and I presume they wouldn’t like it if they knew what Citi was doing.

Well, it’s just another life lesson: Citi is too big to fail — and too big to do right by its customers. I hope readers of this post will keep that in mind the next time they get a credit card offer from Citi.

Leave a Reply