The short version of a long story is that Charles Schwab sold me auction-rate securities, promising liquidity, then stonewalled me when the market disappeared for the ARSs. Meanwhile, every other firm on the planet — and I mean every one — made their clients whole. Goldman Sachs, the auction agent for the ARSs I bought: settled. Fidelity: settled. BofA: settled. TD Ameritrade (late of zero-doc mortgage loan fame): settled.

You can only imagine the lengths I’ve gone to to try to bring this to the attention of regulators. I’ve spoken to regulators in Massachusetts (the issuer of the ARS I bought, the proceeds of which were used to finance the Big Dig), Illinois, and last summer, New York.

I’ve written letters…called representatives…filed complaints with FINRA (famous for being the securities industry’s favorite regulator and the former home of the new SEC chairman. Buy lots of empty mattresses as long as these people are protecting you).

I clearly remember the conversation I had with the NY AG’s office last year. They “got it” but when nothing happened for months, I assumed that office, like all the others I had implored, had moved on to more newsworthy pursuits. Like compensation at AIG and why Lehman Brothers’ collapse was good for the candle-making industry.

Then, finally — finally! — last week, the New York State Attorney General — from among all the attorneys general in the country who were beating their chests about protecting investors last year — sent Charles Schwab a demand letter (attached below).

Charles Schlemeil had convinced themselves they hadn’t lied…they hadn’t stolen my money…that it was those nasty Wall Street firms who were at fault when the ARS auctions tanked. “We’re not the bad guys,” they claimed. “We just sold these things ‘downstream.’ We don’t have anything at all to apologize for or make good on.” Schwab stood on principle! It was a victim, too!

Principle, shminsciple. Now that the NY AG is onto them, they’re talking about how much it’ll cost them to hold off the litigation and whether or not that’s a better deal for them than paying up. This was always a calculation of cost and until now it simply cost those bozos-in-$900-suits less to stonewall than to pay up. When nobody appeared to care, it was easy to argue principle.

Yes, I’m upset that I can’t get to my money…that Schwab lied to me…that talking to Chuck turned out to be talking to a wall. That Schwab is full of schit when it comes to doing the right thing — what everyone else did — for their clients. But mostly, I was unhappy that in the face of such obvious avarice and fraud, none of the responsible regulators did anything about it. One nastygram like this was all I was looking for…and now that my home state AG has sent it, it’s only a matter of time until Charles Schwab capitulates.

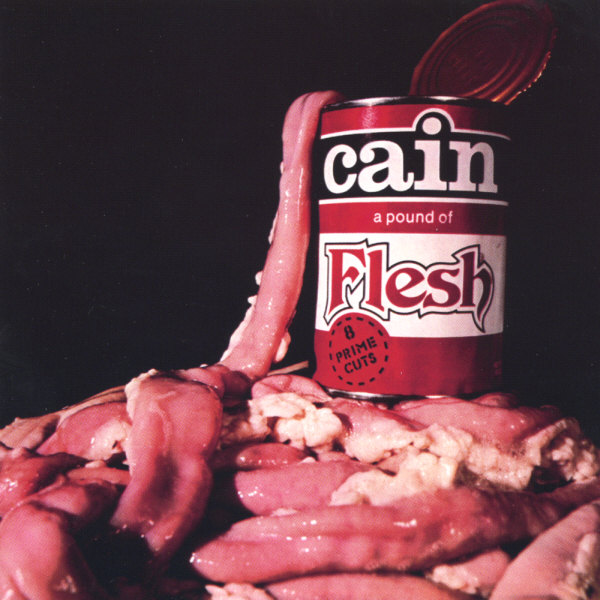

But until then, I am anticipating the pound of flesh the NY AG will extract from Schwab and grateful to my fellow Noo Yawkers for stickin’ with it for us little guys.

Leave a Reply